Illuminating Energy Security: Assessing Risks and Resilience in Europe & Eurasia

Policy Brief | June 2023

By Rodney Knight, Amber Hutchinson, Ana Horigoshi, and Samantha Custer

This research was made possible with funding from USAID's Europe & Eurasia (E&E) Bureau via a USAID/DDI/ITR Higher Education Solutions Network (HESN) cooperative agreement (AID-A-12-00096). The findings and conclusions of this country report are those of the authors alone and do not necessarily reflect the views of our funders and partners.

Executive Summary

The conflict between Ukraine and Russia and the associated energy crisis in Europe and Eurasia (E&E) have heightened the focus on energy security. Over the past three years, AidData, a research lab at William & Mary, has developed an Energy Security Index (ESI) for the E&E region. Results from the ESI provide insights into the strengths and weaknesses of energy policies, governance, supply, and infrastructure. The ESI also highlights the risks to the energy systems in countries and the resilience of those systems to political, economic, technological, and environmental shocks. The ESI delves deeply into the constituent parts of energy security, with dimensions consisting of Met Need for Energy (MNE), Energy Supply, Energy Risk, Energy Resilience, and Country Characteristics. Ultimately, the index supports the efforts of policymakers to bolster energy security by improving the diagnosis of opportunities for policy change in specific countries and across the E&E region.

In this policy brief, we present results for the ESI in 17 Assistance to Europe, Eurasia and Central Asia (AEECA) countries receiving U.S. Government (USG) assistance in four regions: the Balkans (Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia); the Caucasus (Armenia, Azerbaijan, and Georgia), former Soviet states (Belarus, Moldova, and Ukraine); and Central Asia (Kazakhstan the Kyrgyz Republic, Tajikistan, Turkmenistan, and Uzbekistan). We also examine energy security in 11 countries in regions that formerly received USG assistance (Bulgaria, Czech Republic, Croatia, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovenia, and Slovakia). Of these, we chose Croatia as a comparator for this report, because it was among the last of the former assistance countries to graduate from assistance and at the time of graduation had characteristics similar to those of the current assistance countries.

While our review of the ESI results reveals some common patterns across countries, these results are by no means monolithic. Distinct trends emerge across regions and countries. All 17 AEECA countries experienced increases in energy security from 2000 to 2020. The amount of the increase, however, varied greatly, from 0.002 percent in North Macedonia to 21.3 percent in Georgia. Countries within regions tended to have similar trends, but some regions fared better than others. The Balkans showed the most improvement overall, while the Central Asian States started and remained the lowest across time. Croatia and the other 10 former assistance countries outperformed the AEECA countries throughout the period.

One hallmark of this ESI is the ability to dig down deep into the sub-components of energy security. These five primary dimensions (Met Need for Energy, Energy Supply, Energy Risk, Energy Resilience, and Country Characteristics) break down further into 22 categories. At the category level, important insights emerge on elements of energy security amenable to policy change and programmatic interventions.

To more thoroughly understand the dynamics of how these categories impact energy security, we examine three countries that typify the different changes that occurred in this region. Georgia serves as an example of dramatic change, transforming from a relative laggard to a rising star in the region. Bosnia and Herzegovina began with promise but faced relative stagnation over time. Moldova started as the country with the lowest energy security but improved greatly over time, although it still lags behind other countries due to a virtual absence of energy resources. The successes and struggles of each of these countries point to where policy and programmatic change could strengthen future efforts to improve energy security.

A critical challenge for these countries is a relative lack of energy supply. No country had strengths in supply across all types of energy (fossil fuels, nuclear, and renewable energy). Most remain heavily dependent on fossil fuels, much of which comes from Russia. Efforts to diversify the sources of fossil fuels could stabilize energy security and reduce the leverage Russia has on many of these countries. In Moldova, a natural gas pipeline being built to Romania will enable Moldova to access sources of natural gas other than those from Russia.

Renewable energy offers the possibility of greater energy independence for these counties. Some AEECA countries have high levels of hydropower. Approximately 75% of Georgia’s electricity generation comes from hydropower plants. Bosnia and Herzegovina and other Balkan states also have high levels of hydropower. All of these countries could improve their energy security through greater focus on renewable sources of energy. Access to European electricity markets through ENTSO-E (the European Network of Transmission System Operators for Electricity) is another avenue for increasing access to diverse energy sources. Many of the Balkan countries already have utilities that are ENTSO-E members. Ukraine and Moldova also have emergency connectivity that allows them to trade electricity with ENTSO-E members.

A beacon of hope for these countries has been rising levels of financing from Development Assistance Committee (DAC) countries to support upgrades and expansions to energy infrastructure, much of which is aging to the point of being difficult to maintain. Improving infrastructure contributes to energy resilience, and DAC financing provides more favorable terms than financing from countries such as the People’s Republic of China (PRC). All of the AEECA countries experienced increases in DAC financing from 2000 to 2019. When COVID-19 occurred, DAC financing universally dropped. A key policy effort post-COVID-19 must be to return to prior levels of DAC financing for energy infrastructure improvements in these countries.

Energy system governance increased for many of these countries. Like financing, energy systemgovernance contributes to greater energy resilience. Countries can improve energy system governance through better regulatory environments including creating an environment conducive to more diversity in energy supplies and energy trade within and across countries.

Improvements in energy efficiency and reductions in energy consumption can together bolster energy security by reducing the amount of energy required by these countries. In Moldova, investment from the European Investment Bank for renovations and upgrades to the rail system can increase energy efficiency by offering a more efficient alternative to transport via roadways.

Introduction

AidData, a research lab at William & Mary, has developed an index to measure the energy security of countries in the Europe & Eurasia (E&E) region. This index tracks energy security trends to help policymakers target their assistance and monitor results over time. It accounts for nuances of energy security within countries, while facilitating comparability across the region. In addition to producing an overall measure of energy security, the index breaks this concept down into its constituent parts—Met Need for Energy (MNE), Energy Supply, Energy Risk, Energy Resilience, and Country Characteristics. The ultimate objective is to bolster energy security by improving how areas of opportunity can be diagnosed in specific countries and across the region.

|

We define energy security as “the continuous and resilient supply of energy in a country when and where needed sufficient to meet residential, commercial, and industrial demand at an affordable cost to the end users.” |

In this policy brief, we present results for the Energy Security Index (ESI) in 17 Assistance to Europe, Eurasia and Central Asia (AEECA) countries receiving U.S. Government (USG) assistance in four regions: the Balkans (Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia), the Caucasus (Armenia, Azerbaijan, and Georgia), former Soviet states (Belarus, Moldova, and Ukraine), and Central Asia (Kazakhstan, the Kyrgyz Republic, Tajikistan, Turkmenistan, and Uzbekistan). Figure 1 displays the AEECA countries in these four regions.

Figure 1: Map of Assistance to Europe, Eurasia and Central Asia (AEECA) Countries

The Energy Security Index (ESI)

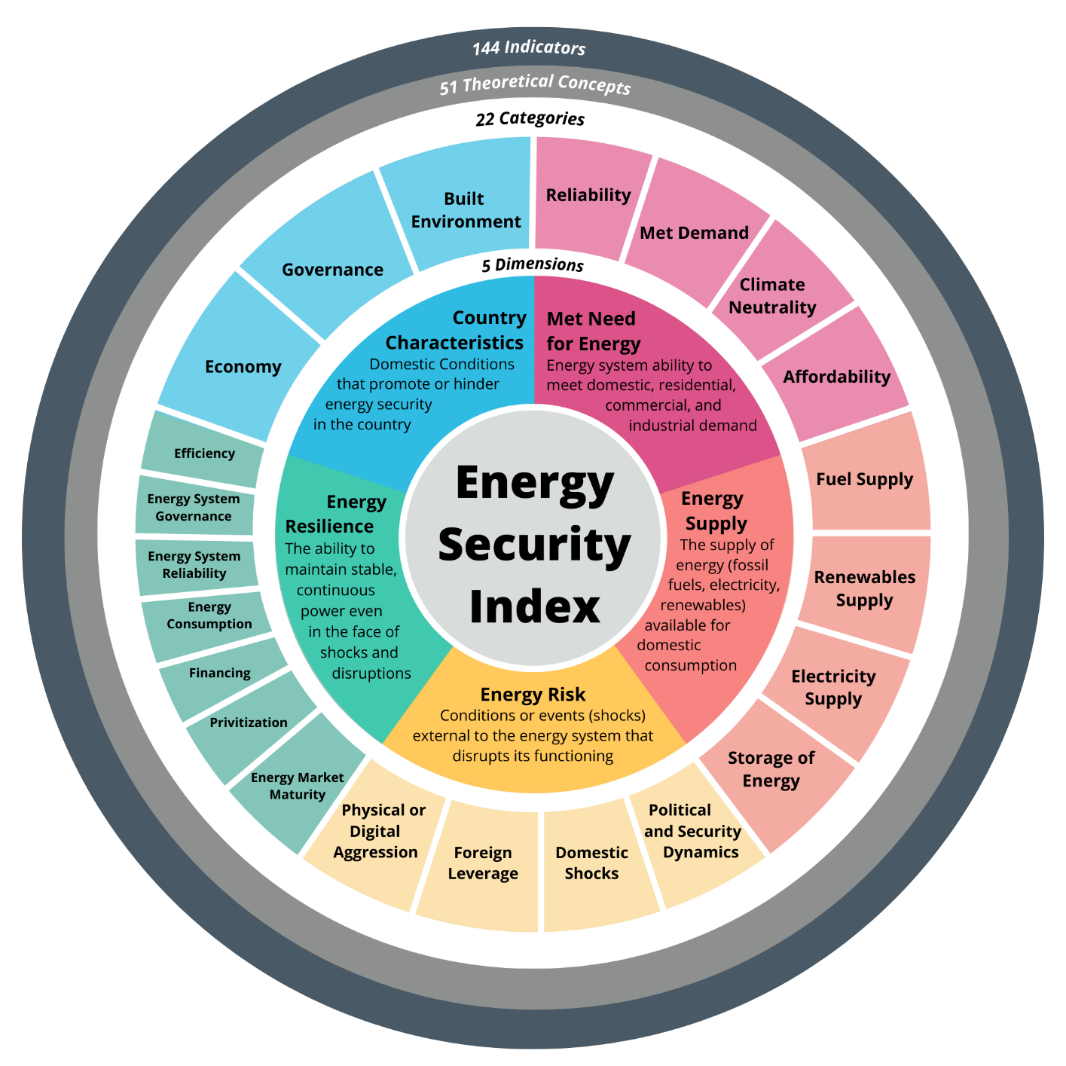

Quantifying energy security is like peeling the layers of an onion. For an index to capture the complexity of an issue like energy security, it needs to be usable at multiple levels of specificity and abstraction. Our ESI models four layers, enabling users to dive deeply into specific niches when relevant or see a high-level view of the complete picture for a given country and across the E&E region. At its most granular, our index tracks 144 distinct indicators related to energy security. Building from the ground up, these indicators provide data that represents 51 different theoretical concepts. We combined similar concepts into 22 thematic categories, which represent 5 main dimensions of energy security, as seen in Figure 2.

Figure 2: Basic Components of the Energy Security Index (ESI)

Met Need for Energy (MNE): We define met need for energy as: “the degree to which the energy system, internal and external to the country, meets the residential, commercial, and industrial energy requirements within the country.” MNE differs from energy security, in that MNE may be achieved in a way that is not resilient to conditions or events outside the energy system. A country dependent on outside sources of energy may have a high MNE but be vulnerable to energy shortages if external sources reduce supply.

Energy Supply (ES): We define energy supply as: “the supply of fossil fuel, renewable, and electrical energy available for residential, commercial, and industrial consumption within a country.” In this definition, we incorporate the amount of energy and exclude the infrastructure required to produce that energy. We focus this definition on energy supply and not whether this supply meets end-user demand.

Energy Risk (ERK): We define energy risk as: “conditions or events (shocks) external to the energy system that are disruptive to the continuous functioning of that system.” Though external to the energy system, these conditions and shocks could be within the country where that energy system functions. Importantly, unlike other ESI dimensions, this dimension measures a negative attribute (shocks). The ESI accommodates this by using its Energy Risk dimension to track the inversion of risk. In other words, a country with low risk of shocks would have a high score in this dimension. If a country’s ESI Energy Risk score increases, it indicates that the country is at lower risk of shocks.

Energy Resilience (ERL): We define energy resilience as: “an energy system that maintains stable and continuous power in the presence of short-term shocks and longer-term factors disruptive to the system.” Resilience is distinct from risk, in that resilience relates to actions that a country can take to mitigatethe effects of risk, whereas risk relates to outside factors over which a country has little control.

Country Characteristics (CC): Finally, we define country characteristics as: “conditions within a country that promote or hinder energy security in the country.”

How This Index Improves Upon Prior Work

We designed the Energy Security Index to build on concepts from other energy security indices. To capture the subtleties of energy security, the ESI covers key elements present in other indices in greater depth. This index provides:

- A comprehensive look at energy security

- The ability to examine trends in components of energy security

- A focus on country level, in addition to global and regional levels

- A combination of political/geopolitical considerations with the technical aspects of energy security

Many other energy security indices contain at least some indicators comparable to our five dimensions. Few cover the breadth of information our index provides at the category level. Appendix A compares other indices with our Energy Security Index in more detail.

Percentage of Energy Security Indices* that include any information on:

*Out of 39 assessed indices

Initial Results

Current Versus Former AAECA Countries

To put energy security for the 17 AEECA countries into perspective, we calculated ESI scores for 11 countries in the region that had previously received USG assistance. In addition to trends for AEECA countries, the figures below present trends for Croatia as a comparator. As the most recent country to graduate from USG assistance, Croatia is nearest to the AEECA countries in terms of its level of development. Like Croatia, the 10 other graduate countries generally have ESI values above those for the AEECA countries.

Balkans

Energy Security Index (ESI) Scores

Index Range: 0-100. Croatia is included as a non-AEECA comparator for all 17 AEECA countries, including those outside the Balkans. “AEECA” refers to the 17 countries receiving U.S. Government “Assistance to Europe Eurasia and Central Asia.”

Caucasus

Energy Security Index (ESI) Scores

Index Range: 0-100. Croatia is included as a non-AEECA comparator for all 17 AEECA countries, including those outside the Balkans.

Central Asia

Energy Security Index (ESI) Scores

Index Range: 0-100. Croatia is included as a non-AEECA comparator for all 17 AEECA countries, including those outside the Balkans.

Eastern Europe

Energy Security Index (ESI) Scores

Index Range: 0-100. Croatia is included as a non-AEECA comparator for all 17 AEECA countries, including those outside the Balkans.

Regional Trends

Energy security is not monolithic across the 17 E&E countries. Distinct trends emerged in general and regionally. Across all 17 countries, energy security grew throughout the time period. Yet despite this growth, disparities across and within regions persist. Former Soviet states and the Central Asian states had the lowest ESI values overall. The Balkan states fared the best, followed by the Caucasus states. Within each region, one or two countries had distinct advantages over the others. Among the Balkan states, Montenegro and Serbia consistently outperformed their peers, even exceeding a few of the countries that graduated from assistance in the early 2000s. Ukraine fared better than the other two former Soviet states, but still lagged behind countries in other regions. Kazakhstan and Kyrgyzstan performed better than other Central Asian states. Georgia converted from a laggard among the Caucasus states to a relatively high performer at the end of the study period.

Change in ESI, 2000-2020

Energy Security Index (ESI) values for 2000 and 2020 are listed on either side of each arrow. Percent change is listed in parenthesis after each country. ESI values can range from 0 to 100.

Improvement Varied Across Countries

Countries receiving assistance did not improve to the same degree over time. Three countries (Ukraine, Georgia, and Moldova) improved by 13 percent or more from 2000 to 2020. Ukraine and Moldova are notable among these countries. Ukraine improved the most among the AEECA countries, increasing its ESI score by 21.3 percent. Moldova started at the lowest level across all assistance countries, then improved to a level at or above several other countries. Ten of the countries improved steadily, ranging from around 7 to 11 percent improved. Four countries (Montenegro, Bosnia and Herzegovina, Turkmenistan, and North Macedonia) improved only modestly. North Macedonia began on par with Croatia in 2000 but experienced relative stagnation during later years, resulting in the smallest improvement across the 17 countries.

Financing Bolsters Energy Security

Increased financing from Development Assistance Committee (DAC) countries for energy infrastructure in the 17 AEECA countries drove resilience upward over time. Without upgrades or replacement, aging infrastructure reduces the reliability of power generation. DAC financing helped to offset this decline in resilience from aging infrastructure. Across the 17 countries, resilience increased from 2000 to 2020. Increases in resilience contributed to the upward trend in energy security across these countries.

Three Countries, Three Stories

ESI in Spotlight Countries

ESI Scores (Index Range: 0-100)

This policy brief focuses on three country case studies to spotlight different trajectories for energy security. We chose three countries from different regions and trajectories to highlight regional differences, as well as differences between countries. Georgia’s example highlights how a country that started relatively low in energy security improved more than any other AEECA country, save Ukraine. Understanding the drivers of this improvement could help with designing programs for other countries. Bosnia and Herzegovina, on the other hand, started higher but experienced relative stagnation over time. It is important to understand the barriers to progress in Bosnia and Herzegovina to not only to improve programs there but also to find ways to help other countries that are stagnating in terms of energy security. Moldova, by contrast, started the lowest of all in energy security and made substantial progress. As with Georgia’s case, understanding what drove progress in Moldova could help program managers to design future programs in Moldova or elsewhere to help other countries make better progress. Both Moldova and Georgia made substantial progress despite internal conflicts that posed risks to energy security. Bosnia and Herzegovina, on the other hand, was not able to move past internal conflicts to make substantial improvements in energy security.

Country Spotlight: Georgia

Overall ESI Score: Georgia versus Croatia

Index Range: 0-100

Georgia by ESI Dimension

ESI Dimension Scores (Index Range: 0-100)

Energy Security Amidst Challenges

Georgia represents a story of great success in energy security from 2000 to 2020, despite challenges it faced from internal conflict during the period. In analyzing Georgia's performance, we highlight both the drivers of this success and factors in need of improvement. It is important to not take the overall ESI score as the whole story, particularly when so many factors contribute to energy security or the lack thereof. In this section, we will dig down into the details of the dimensions, categories, and even indicators to better understand the nuances of the energy security picture in Georgia.

At the overall level of energy security, Georgia transformed from a country with the second lowest ESI score among AEECA countries in 2000 to one of the top four in 2020. How did this happen? Among the five ESI dimensions, energy supply in Georgia remained relatively flat throughout the period, while the other four dimensions experienced varying levels of increase. Country characteristics and energy resilience experienced the greatest increases. Energy risk [1] and met need for energy had more modest increases.

Energy Supply and Met Need for Energy Still Challenging

That energy supply remained relatively flat over time in Georgia is of concern, regardless of the improvement in other ESI dimensions. Without energy supply, no country can truly be energy secure. In our formulation of the supply dimension, we include imports as well as domestic production of electricity and fossil fuels. Except for Azerbaijan (and to a lesser degree Ukraine), oil and natural gas reserves and production are very limited in AEECA countries. Georgia is no exception. Georgia started with low values for fossil fuel supply and electricity supply. These values declined slightly over the period. Storage of energy, which includes fossil fuel stocks and hydroelectric pumped storage, and renewables supply increased modestly over time.

Georgia's Met Need for Energy (MNE)

The ability of the energy system to meet domestic residential, commercial and industrial demand

MNE Component Scores (Index Range: 0-100)

Georgia’s Energy Supply (ES)

The supply of energy (fossil fuels, renewables, electrical) available for domestic consumption

ES Component Scores (Index Range: 0-100)

Renewables supply is a potential area for progress. Georgia is among the highest of the AEECA countries in terms of renewables capacity and production. Montenegro is the only AEECA country that consistently had per capita renewable electricity capacity and generation values above those for Georgia. About 75% of Georgia’s electricity generation comes from hydropower (IEA, 2021a). Georgia also has a small amount of installed wind capacity (about 20MW) but has the potential for much more. These results suggest that Georgia could work with funders and investors to increase renewable (specifically, hydropower and wind) capacity.

Though the situation is more encouraging than that of energy supply, met need for energy in Georgia faces increasing demand, expanding the carbon footprint of the country and reducing the ability of Georgia to meet demand through local production. Georgia produces almost none of its fossil fuel requirements domestically, which makes it vulnerable to energy price fluctuations (IEA, 2021). Georgia fares better for electricity but will only keep up with rising demand by increasing capacity, particularly renewable capacity. A Romanian Aid report suggests Georgia consider green hydrogen production by increasing installed wind capacity (ICG, 2010). While this may not seem realistic in the near term, it recognizes the need for Georgia to increase renewables capacity and address the related issues of storage and load balancing.

Managing Risk to Improve Energy Security

Both energy risk and energy resilience are part of the overall management of risks to a country's energy security. Risks are factors over which a country has little control, whereas resilience represents areas where a country can take action to make itself more energy resilient.

Except for domestic shocks, the categories making up the Energy Risk (ERK) dimension all showed progress in Georgia, contributing to a more energy secure environment over time (see the figure below). Political stability increased over time, even with the 2008 conflicts in Abkhazia and South Ossetia (International Crisis Group, 2010). The aggression and foreign leverage categories improved after 2010, indicating there was less aggression and foreign leverage, resulting in more energy security.

The Energy Resilience (ERL) dimension was bolstered by two factors: financing and energy system governance (see the figure below). Financing from Development Assistance Committee (DAC) countries grew dramatically from 2000 to 2019—an increase of 1,019 percent or a ten-fold increase. The drop in financing in 2020 was experienced across countries and is likely due to COVID-19. Energy system governance saw a noticeable (albeit much more modest) increase over time.

Energy system reliability was the only resilience category that experienced an overall decline. Such a decline is not surprising, given the aging energy infrastructure among all the AEECA countries. Financing from the People's Republic of China and Russia appears in the foreign leverage category of the energy risk dimension. The improvement in energy security related to foreign leverage suggests that such financing did not actually increase foreign leverage.

Georgia's Energy Risk (ERK)

Conditions or events (shocks) external to the energy system that disrupt its functioning

ERK Component Scores (Index Range: 0-100)

Georgia’s Energy Resilience (ERL)

The ability to maintain stable, continuous power even in the face of shocks and disruptions

ERL Component Scores (Index Range: 0-100)

Economy and Governance Support to Energy Security

In addition to improvements in financing in the Energy Resilience dimension (see figure above), increases in the economy and governance categories of the Country Characteristics dimension (see figure below) were key drivers of growth in Georgia's overall energy security. The economy category subindex grew by 52.8 percent from 2000 to 2020 and governance subindex grew by 99.3 percent. The built environment subindex increased slightly in the early 2000s and remained stagnant after 2005.

Georgia’s Country Characteristics (CC)

Domestic conditions that promote or hinder energy security in the country

CC Component Scores (Index Range: 0-100)

The economy and governance categories were the key drivers in the 64.2 percent increase in Georgia's Country Characteristics score. Economic growth benefits energy security by creating greater financial resources that can be spent on energy at the government and private levels. Good governance can benefit energy security through a well-functioning political system that can create and implement policies supportive of energy security.

Country Spotlight: Bosnia and Herzegovina

Overall ESI Score: Bosnia and Herzegovina versus Croatia

Index Range: 0-100

Bosnia and Herzegovina by ESI Dimension

ESI Dimension Scores (Index Range: 0-100)

Understanding Relative Stagnation in Energy Security

While Georgia is a story of success, Bosnia and Herzegovina experienced relative stagnation in energy security from 2000 to 2020. During this time, energy security in Bosnia and Herzegovina grew by only 3 percent, compared to 21.3 percent in Georgia and 13 percent in Moldova. Our goal is to understand what is driving this stagnation in Bosnia and Herzegovina's energy security and to suggest actions to overcome this stagnation. A starting point is to examine areas of positive movement in energy security. We will look for areas that grew the most and see if there are ways to increase progress in those areas. Reinforcing areas of strength may be more effective than trying to make progress in areas that have stagnated because of barriers or mismanagement.

An example of this is the comparison of privatization and financing. Privatization should, in theory, attract foreign investment and expertise, both of which are needed for upgrading and replacing aging energy infrastructure. Prior failed attempts at privatization in Bosnia and Herzegovina have discouraged further privatization (Santrucek, 2019). An alternative to privatization is financing. Investment from DAC country donors in the energy sector has increased in Bosnia and Herzegovina, as in other AEECA countries. For the time being, working with donors to target such investments may be a more productive approach than privatization.

Bosnia and Herzegovina's Met Need for Energy (MNE)

The ability of the energy system to meet domestic residential, commercial and industrial demand

MNE Component Scores (Index Range: 0-100)

Bosnia and Herzegovina's Energy Supply (ES)

The supply of energy (fossil fuels, renewables, electrical) available for domestic consumption

ES Component Scores (Index Range: 0-100)

Meeting Demand and Increasing Supply without Reverting to Coal

Bosnia and Herzegovina has a growing demand for energy, which shows up as reductions over time in carbon neutrality and met demand. [2] How can Bosnia and Herzegovina meet this growing demand and avoid increasing carbon production? Given the substantial coal resources in the country, it is not surprising that Bosnia and Herzegovina resorted to building a new 300 MW coal-fired power plant. To compound the problem, the People’s Republic of China (PRC) has provided financing for this project (Zuvela, 2016) . Such financing from PRC increases the leverage the PRC has over Bosnia and Herzegovina and potentially reduces energy security.

Bosnia and Herzegovina has alternatives that may both help to meet demand and reduce carbon emissions. Already it has substantial installed hydropower capacity which could be expanded. Wind energy is another option. Bosnia and Herzegovina's state-owned power utility ERS plans to add hydroelectric and windpower plants by 2026, with a capacity of 430 MW (Reuters, 2022). A potential downside is that some of the financing will be from the PRC. On a more positive note, Germany’s KfW provided funding for Bosnia and Herzegovina’s first wind farms in 2018 with a total capacity of 134 MW (CEE BankWatch Network, 2022). A potential intervention is to encourage other DAC donors to provide funding for further renewable power generation projects.

How Can Bosnia and Herzegovina Manage Risk to Improve Energy Security?

The risk dimension of energy security declined by 2.8 percent from 2000 to 2020 in Bosnia and Herzegovina, representing a rise in the actual risk. [3] The resilience dimension helped to counter this trend, increasing by 4.8 percent over the period. What can be done to manage risk and increase energy security? If we examine the categories within risk and resilience, we can find some clues.

Among the Energy Risk (ERK) categories, only political stability improved substantially (see figure below). Political stability is not a factor that energy programs will influence, but other development programs can focus on this. Given past conflicts, political stability is especially important in Bosnia and Herzegovina, as political unrest is not good for energy security. Creating political stability could, however, come at a cost to energy security. Satisfying the needs of different ethnic groups to support political stability can slow reform processes, given the complexities of negotiations between these groups.

The Energy Resilience (ERL) dimension offers alternatives to focusing on political stability. Both the financing and energy system governance improved over the period (see figure below). These two categories were able to counter declines or stagnation in the other five categories to produce an increase in energy resilience over time. The financing subindex increased dramatically from 2000 to 2019, with a steep decline in 2020, which may be due to COVID-19. The energy system governance subindex followed a trajectory very similar to that of financing from 2008 onwards, except that energy system governance continued to increase after 2019. Focusing future programs on financing and energy system governance may therefore increase energy security.

The other five categories in the resilience dimension either declined or stagnated. Two of these show potential for interventions. Energy consumption and efficiency are related categories that could benefit from programs focused on efficient buildings, efficient appliances, and training individuals on energy efficiency and reducing energy consumption.

Flooding is a risk factor that should be taken into consideration as well, even though there is little that can be done to control its effects. Extreme flooding has led the domestic shocks category to fluctuate over time and thereby cause fluctuations in risk. Record rainfall struck Bosnia and Herzegovina several times from 2009 to 2014. The related flooding affected over one quarter of the country's 4 million people (ACAPS, 2014). In November of 2021, a large flood affected 18 municipalities across Bosnia and Herzegovina (IFRC, 2022). These domestic shocks led to a worsening of the country's energy risk scores in the periods when they occurred.

Bosnia and Herzegovina’s Energy Risk (ERK)

Conditions or events (shocks) external to the energy system that disrupt its functioning

ERK Component Scores (Index Range: 0-100)

Bosnia and Herzegovina’s Energy Resilience (ERL)

The ability to maintain stable, continuous power even in the face of shocks and disruptions

ERL Component Scores (Index Range: 0-100)

Country Context Provides Little Support for Energy Security

As with its overall ESI score, Bosnia and Herzegovina's Country Characteristics score remained fairly stagnant. Prior to 2005 governance improved, but it then declined thereafter. The economy category stayed flat until 2011, then improved for the rest of the period. Although Bosnia and Herzegovina's GDP per capita increased throughout the period, its growth was smaller relative to other countries and the economy subindex therefore appears stagnant prior to 2011. The built environment subindex did not fare much better, experiencing some fluctuations without overall improvement by the end of the period.

Bosnia and Herzegovina’s Country Characteristics (CC)

Domestic conditions that promote or hinder energy security in the country

CC Component Scores (Index Range: 0-100)

Country Spotlight: Moldova

Overall ESI Score: Moldova versus Croatia

ESI Scores (Index Range: 0-100)

Moldova by ESI Dimension

ESI Dimension Scores (Index Range: 0-100)

Starting Low, Improving Well, But Still Behind

Like Georgia, Moldova started with a low ESI score and showed great improvement. Moldova began at the bottom of the list of AEECA countries and improved well but only reached the lower end of countries interms of energy security. While Moldova followed a similar pattern to Georgia, Moldova did not make the same level of progress Georgia did across dimensions. Moldova increased well in its Country Characteristics and Energy Resilience dimensions and improved more modestly in Met Need for Energy and Energy Risk. Given that it has virtually no fossil fuel resources, Moldova declined in its Energy Supply score. A recent development that could improve Moldova's electricity supply was its entry into ENTSO-E, the European Network of Transmission System Operators. Unlike Georgia, which has a reasonable amount of electricity generation capacity, Moldova has very little electricity generation capacity, other than a large thermal plant in Transnistria. Having a large portion of its electricity generation capacity in one place puts Moldova at risk.

How Can Energy Needs Be Met with Such Dependence?

Limited supply is the story across AEECA countries and is an issue for countries that graduated from country assistance. The situation appears even worse for Moldova. With virtually no fossil fuel resources, much of its electricity generation capacity in Transnistria, and its dependence on Russia for oil and natural gas, what should Moldova do? Since dependency is a given for Moldova, the challenge is to make that dependency less onerous. To make the situation more viable, Moldova needs to create opportunities to work with trading partners that are less likely to take advantage of the dependency. Currently, Moldova relies heavily on Russia for natural gas and oil. By building a natural gas pipeline to Romania, Moldova is creating an alternative that may be able to provide natural gas from sources other than Russia (Necsutu, 2020). The project has received funding from a variety of European funders, including the European Investment Bank (EIB), the European Union (EU), and the European Bank for Reconstruction and Development (EBRD) (Global Energy Monitor, 2022). For electricity, Moldova now can trade more freely with Europe and reduce its dependence on Transnistria and the Russian electric grid for power (ENTSO-E, 2022a). ENTSO-E has increased Moldova’s allowable trade volumes with the Continental Europe Transmission System Operators in phases (ENTSO-E, 2022b, ENTSO-E, 2022c).

Moldova’s Met Need for Energy (MNE)

The ability of the energy system to meet domestic residential, commercial and industrial demand

MNE Component Scores (Index Range: 0-100)

Moldova’s Energy Supply (ES)

The supply of energy (fossil fuels, renewables, electrical) available for domestic consumption

ES Component Scores (Index Range: 0-100)

In an Environment of Conflict, How Can Moldova Reduce Risk and Increase Resilience?

Data for the ESI covers through 2020 but not the current period of conflict in neighboring Ukraine. These data, however, can provide some insights into past risk and resilience, which can help us to better understand how to reduce current risk and increase resilience.

From 2000 to 2020, Moldova experienced a 7.6 percent increase in the subindex value for energy risk, which implies that risk declined over the period. [4] While overall energy risk decreased over time (see figure below), it is not clear if any categories of risk contributed consistently to this, given the fluctuations in the indicators that feed into these categories. To provide insights into potential areas for programming requires a look at the indicators that make up the categories. Among the categories for the Energy Risk (ERK) dimension, only foreign leverage provides opportunities for interventions directly related to energy. [5] A central theme in foreign leverage is external control of fossil fuel and financial resources.

Moldova’s Energy Risk (ERK)

Conditions or events (shocks) external to the energy system that disrupt its functioning

ERK Component Scores (Index Range: 0-100)

Moldova is completely dependent on external sources for oil, natural gas, and coal, much of which is imported from Russia. As mentioned earlier, the pipeline to Romania could reduce Moldova’s dependence on Russian natural gas. Moldova has little oil resources, although the Government of Moldova has given a concession to a U.S. company to explore for oil (IEA, 2021b). Moldova has some lignite coal resources, but it does not currently produce coal (IEA, 2021b; EIA, 2022).

In terms of foreign leverage and energy financing, the PRC has provided loans to Moldova for road projects and could provide funding for energy infrastructure projects (Harper 2021, Davi 2020). Another form of leverage is through the financing of energy infrastructure projects by a single external country. In 2020, based on our analysis of OECD Creditor Reporting System data (OECD, 2021), 57.4 percent of external energy sector debt in Moldova was held by a single country. Diversifying sources of funding and attracting funders with more favorable terms than the PRC should be priorities for energy sector financing programs in Moldova.

Moldova’s Energy Resilience (ERL)

The ability to maintain stable, continuous power even in the face of shocks and disruptions

ERL Component Scores (Index Range: 0-100)

In the Energy Resilience (ERL) dimension, three categories have shown improvement that suggest potential for further programming. The financing and efficiency subindexes improved from 2000 to 2019 when both experienced a sharp decline (see figure above). The energy system governance subindex experienced a gradual but steady increase over the period. Supporting governance going forward makes sense, given the progress made to date. Financing, as in other countries, has increased dramatically. This financing is from DAC countries and therefore has better terms than that from the PRC. Programs should engage European donors to provide additional financing and suggest ways to make that financing most effective for energy security. As in other AEECA countries, Moldova's energy infrastructure is aging and requires upgrades or replacements. There are also opportunities for hydropower (IEA, 2021b) and wind, which could move Moldova into a greener energy future. Moldova already has substantial renewable biomass capacity, but that will not have the same benefit for carbon emissions as other renewable sources. Finally, energy efficiency has shown a large increase in Moldova recently. Programs should learn from what is working in terms of efficiency and build upon those lessons. As discussed earlier, restoration of the rail system could be part of the work to improve energy efficiency.

Challenges Remain, Despite Improving Country Characteristics

Over the past two decades, Moldova has made great strides in the Country Characteristics dimension (see figure below). Improvements in the economy and built environment [6] drove this progress. The subindex score for the economy grew from 41.7 to 59.6, a 43 percent increase. Similarly, the subindex score for the built environment grew by 39.4 percent. The governance subindex experienced an overall increase of 8.1 percent, but the up and down fluctuations over the period make it difficult to determine if this is a real increase.

Moldova’s Country Characteristics (CC)

Domestic conditions that promote or hinder energy security in the country

CC Component Scores (Index Range: 0-100)

Up until 2020, the future for Moldova's economy appeared positive. The onset of COVID-19 caused the economy to slow down, and the war in Ukraine brought economic growth to a standstill (Nuttall, 2022). Moldova's economic growth is reliant on remittances and agriculture, including production of agricultural products and machinery (Global Edge, 2022; World Bank, 2022). Moldova has previously seen economic growth through agricultural trade with Russia and Europe. Due to the recent crises, the European Union has waived trade tariffs on select agricultural products to encourage Moldovan exports to Europe (News EuropeanParliament, 2022). The rest of Moldova’s economy is highly dependent on imports, particularly in the energy sector. The dependence on imports for fossil fuels makes Moldova’s agriculture-driven economy vulnerable to oil prices. Assisting Moldova to diversify its fossil fuel imports away from Russia is important to the country’s energy security and economic health.

Despite the positive outlook presented by the improvements in the built environment subindex, Moldova’s aging rail system is a cause for concern. The system’s issues have resulted in a decline in market share for transport of goods and passengers via rail, while market share via roadways is increasing (World Bank, 2020). The concern from an energy security standpoint is that transport of goods and people via roadways is less efficient than via rail. To upgrade its rail infrastructure, Moldova has obtained a €74 million investment from the European Investment Bank to modernize rail lines and equipment along a key transportation corridor (EIB, 2021). While such investment is encouraging, a World Bank report on Moldova railways suggests much higher levels of funding are required to modernize the aging railway infrastructure (World Bank, 2020). That report additionally notes a large disparity between investments in roadways and rail, which further degrades the ability of rail to compete with roads for transport. A key area for intervention is for Moldova and European donors to work to increase financing for railways.

Methodology

Data Collection

The Energy Security Index (ESI) includes data collected from 2000 to 2020 covering 144 variables for 17 AEECA countries. Data were compiled from a variety of sources covering all 22 categories that feed into the 5 dimensions. The Energy Information Agency and World Bank were major data sources for many indicators. In order to provide a comparison with more energy-secure countries, data for 11 countries in the region that graduated from USG assistance were also collected. Data sources for the index were chosen based on credibility, accessibility, transparency, and completeness.

Normalization

Indicators typically have different units and scales. Each indicator therefore needs to be normalized before it can be aggregated into the larger index. Normalization transforms indicators to be unitless and on the same scale (i.e., 0 to 100). For the energy security index, we calculated the normalized value with a min-max normalization which compares the value to the range of values across countries and time in the dataset.

Aggregation

To combine indicators into categories, categories into dimensions, and dimensions to produce the overall ESI, normalized scores are averaged at each level of the index. Values from each normalized indicator are averaged to produce category-level values, category values are averaged to produce dimension values, and dimension values are averaged to produce the ESI. Aggregation of this type creates equal weights within each level. This method allows us to dissect the index at each level.

Imputation

Indicator data sources typically will have missing values for specific countries and years. Some countries have less data than others in international sources. Kosovo is a case in point, as some of the international organizations collecting data do not recognize it as an independent country. Temporal coverage, meanwhile, varies due to incomplete reporting by countries or because some data sources do not collect data annually. To avoid bias due to missing data, we impute missing values with data from the country. If no data is available for a country for a certain indicator, we impute values based on other countries. If there is sufficient data in a country, we impute values with a linear regression based on time. If there is not sufficient data, we project the value for the first year with data backward in time, the value for the last year with data forward in in time and use the average of available data in the country for missing values between the first and last values.

Calculation of the Index

Scaling the Energy Security Index from 0-100 enables comparison of country values over time. The index is created by averaging at each level of the index as described in the aggregation section. This process of taking multiple averages centers the index, as high and low scoring values balance one another. Despite closeness in scores, dramatic differences and patterns surface between both individual countries and subregions.

About AidData

AidData is a research lab at William & Mary's Global Research Institute. We help leading international development organizations make better-informed decisions by leveraging novel data, cutting-edge methods, and rigorous evidence. Our team of researchers has a track record of successful partnerships with a wide variety of organizations.

References

ACAPS. 2014. Floods in Serbia, Bosnia and Herzegovina, and Croatia 23 May 2014 - Serbia . ReliefWeb. https://reliefweb.int/report/serbia/floods-serbia-bosnia-and-herzegovina-and-croatia-23-may-2014 .

Nuttall, C. 2022, Multiple crises push Moldova’s economy into stagnation . BNE Intellinews. https://intellinews.com/multiple-crises-push-moldova-s-economy-into-stagnation-255083/ .

CEE BankWatch Network. 2022, The Energy Sector in Bosnia and Herzegovina . https://bankwatch.org/beyond-fossil-fuels/the-energy-sector-in-bosnia-and-herzegovina .

Center for Strategic and International Studies (CSIS). Significant Cyber Incidents . Retrieved April 30, 2021 from https://www.csis.org/programs/strategic-technologies-program/significant-cyber-incidents .

Davi, E. 2021. Moldova’s unexpected opening to China . China Observers in Central and Eastern Europe (Choice). https://chinaobservers.eu/moldovas-unexpected-opening-to-china/ .

Energy Information Agency (EIA). Moldova: 2019 primary energy data. Retrieved September 13, 2022 from https://www.eia.gov/international/overview/country/MDA .

ENTSO-E. 2022a. Commercial exchanges of electricity with Ukraine/Moldova to start on 30 June. https://www.entsoe.eu/news/2022/06/28/commercial-exchanges-of-electricity-with-ukraine-moldova-to-start-on-30-june/ .

ENTSO-E. 2022b. Transmission System Operators for Electricity of Continental Europe agree to increase the tradecapacity with the Ukraine/Moldova power system. https://www.entsoe.eu/news/2022/07/29/transmission-system-operators-for-electricity-of-continental-europe-agree-to-increase-the-trade-capacity-with-the-ukraine-moldova-power-system/ .

ENTSO-E. 2022c. Further update on trading capacity with Ukraine/Moldova. https://www.entsoe.eu/news/2022/09/22/further-update-on-the-trading-capacity-with-ukraine-moldova/ .

European Investment Bank (EIB). 2021. Moldova: Team Europe – EIB invest in modern, save and efficient railway transport . https://www.eib.org/en/press/all/2021-469-team-europe-eib-invests-in-modern-safe-and-efficient-railway-transport-in-moldova .

Global Edge. 2022. Moldova: Economy . https://globaledge.msu.edu/countries/moldova/economy .

Global Energy Monitor. 2022. Romania – Moldova Gas Pipeline . https://www.gem.wiki/Romania-Moldova_Gas_Pipeline .

Harper, J. 2021. Moldova eyes Chinese investment, wary of Montenegro route . Deutsche Welle (DW) https://www.dw.com/en/moldova-eyes-chinese-investment-wary-of-montenegro-route/a-59657451 .

International Crisis Group (ICG). 2010. Georgia: Securing a stable future. ICG: Policy Brief 58. https://www.crisisgroup.org/europe-central-asia/caucasus/georgia/georgia-securing-stable-future .

International Energy Agency ( IEA). 2021a. Georgia energy profile , IEA, Paris. https://www.iea.org/reports/georgia-energy-profile .

International Energy Agency ( IEA). 2021b. Moldova energy profile , IEA, Paris. https://www.iea.org/reports/moldova-energy-profile .

International Federation of Red Cross and Red Crescent Societies (IFRC). 2022. Bosnia and Herzegovina: Floods DREF Operation n° MDRBA013 - Final Report. ReliefWeb. https://reliefweb.int/report/bosnia-and-herzegovina/bosnia-and-herzegovina-floods-dref-operation-ndeg-mdrba013-final-report .

Necsutu, M. 2020. Gas pipeline linking Moldova to Romania nears completion . BalkinInsight. https://balkaninsight.com/2020/04/29/gas-pipeline-linking-moldova-to-romania-nears-completion/ .

Nuttall, C. 2022, Multiple crises push Moldova’s economy into stagnation . BNE Intellinews. https://intellinews.com/multiple-crises-push-moldova-s-economy-into-stagnation-255083/ .

OECD. 2021. Creditor Reporting System (CRS) . OECD.Stat. https://stats.oecd.org/Index.aspx?DataSetCode=crs1 .

Sito-Sucic, D. 2022. Bosnia’s ERS to add 430 MW of renewables by 2026 . Reuters. https://www.reuters.com/business/energy/bosnias-ers-add-430-mw-renewables-by-2026-2022-04-27/ .

World Bank. 2022. The World Bank in Moldova . https://www.worldbank.org/en/country/moldova/overview .

World Bank. 2020. Moldova Railways Policy Note . https://elibrary.worldbank.org/doi/abs/10.1596/35700 .

Zuvela, M. 2016. First Balkan private power plant boosts coal dependence . Reuters. https://www.reuters.com/article/bosnia-energy/first-balkans-private-power-plant-boosts-coal-dependence-idUSL8N1BV3AA .

Appendix A: Comparison of Other Indexes with AidData’s Energy Security Index

|

Index Level |

Percent of Other Energy Security Indexes* that include any information on: |

||

|

Dimension |

Category |

Dimension |

Category |

|

Met Need for Energy |

Reliability |

100% |

8% |

|

Affordability |

44% |

||

|

Efficiency |

55% |

||

|

Climate Neutrality |

51% |

||

|

Other |

30% |

||

|

Energy Supply |

Fuel Supply |

94% |

25% |

|

Renewables Supply |

25% |

||

|

Electricity Supply |

28% |

||

|

Storage of Energy |

3% |

||

|

Other |

11% |

||

|

Energy Risk |

Physical or Digital Aggression |

17% |

8% |

|

Foreign Leverage |

42% |

||

|

Domestic Shocks |

0% |

||

|

Political and Security Dynamics |

17% |

||

|

Other |

0% |

||

|

Energy Resilience

|

Energy System Governance |

40% |

3% |

|

Energy System Reliability |

6% |

||

|

Energy Consumption |

36% |

||

|

Financing |

0% |

||

|

Privatization |

0% |

||

|

Energy Market Maturity |

0% |

||

|

Other |

0% |

||

|

Country Characteristics |

Economy |

39% |

44% |

|

Governance |

17% |

||

|

Built Environment |

8% |

||

|

Other |

29% |

||

|

Other** |

|

8% |

|

|

Note: Only 2 indices incorporate topics from all 5 ESI Dimensions |

*Out of 39 assessed indices **Other topics not covered by the ESI

|

|

|

|

|

|||

[1] Energy risk experiencing a numerical increase in value implies that risk wasreduced. To ensure that higher values for subindexes correspond to higher energy security, indicators (like energy risk) that have higher values when energy security is lower were reversed. For example, for the indicator “Number of cyber attacks reported against domestic energy infrastructure or control systems” higher values initially correspond to greater risk and less energy security. The values of this indicator were reversed to make higher values correspond to higher energy security.

[2] In spite of Bosnia and Herzegovina’s inability to meet energy demand across all uses, including fossil fuels for transportation, it is a net exporter of electricity (CEE BankWatch Network, 2022).

[3] The decline in the risk subindex implies that risk increased. Because risk indicator values are reversed, the risk subindex has lower values (i.e., less energy secure) when risk is higher.

[4] To keep the risk subindex in line with the rest of the ESI—where higher values imply greater or improved energy security—the values of indicators that are higher with higher risk were reversed. The risk subindex therefore has higher values when risk is lower.

[5] Programs to prevent or mitigate aggression and domestic shocks, or enhance political stability are outside the manageable interests of an energy security program.

[6] The built environment category focuses on the urban environment and transportation. Urban growth indicators serve as proxies for development of the urban environment. Indicators for vehicle ownership and railroads serve a proxies for the built environment related to transportation.