Policy Brief

Securing Prosperity, Building Resilience

U.S. Economic Partnership in the Indo-Pacific

The Indo-Pacific and the U.S. have a long track record of partnership, working together to promote sustainable growth and stronger ties through trade, aid, and investment. This fact sheet estimates private sector and U.S. government (USG) engagement with 46 Indo-Pacific economies between 2012 and 2022.

$24.5 Trillion

Trade, aid, remittances & investment over 11 years

18% Growth

U.S. total engagement from 2012 to 2022

$13 Trillion

U.S. imports from the Indo-Pacific

$63.7 Billion

USG bilateral and multilateral support

2113% Growth

USG funding to facilitate conditions for private investment

Insights

Far From Forgotten, Small Island Economies Attracted an Outsized Share of U.S. Engagement

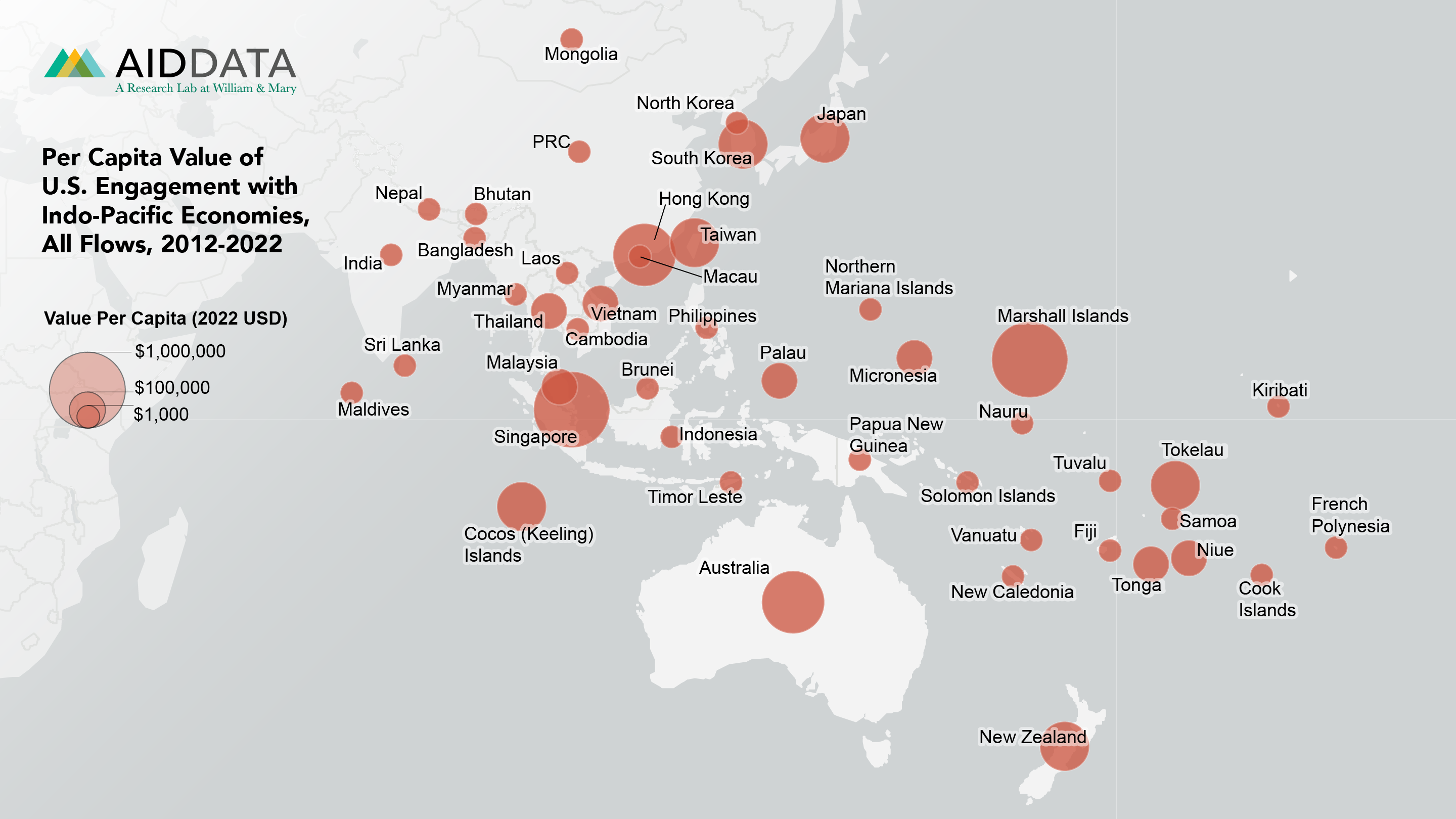

The Indo-Pacific and the U.S. have a long track record of partnership, working together to promote sustainable growth and stronger ties through various public and private-sector-led channels. AidData approximates the total value of U.S. engagement across trade, aid, investment, and remittance flows at $24.5 Trillion across 46 Indo-Pacific economies between 2012 and 2022. If money reflects one’s revealed priorities, then the Indo-Pacific is top-of-mind for U.S. public and private sector leaders, as total engagement with economies in the region enjoyed 18% growth over the 11-year period. Outbound foreign direct investment from the U.S. to the Indo-Pacific ($11 Trillion) and U.S. imports from these economies ($13 Trillion) were the major drivers of this economic value. Large, advanced economies attracted big dollars in absolute terms. However, taking population size into account, small island economies in the Indian and Pacific Oceans attract outsized attention per capita relative to their neighbors.

U.S. Government Indo-Pacific Engagement Evolved from Aid Provider to Investment Partner

Over the last decade, U.S. government (USG) assistance doubled down on financing to help Indo-Pacific economies unlock access to international private investment from the U.S. and elsewhere. It leveraged two important vehicles, the U.S. Development Finance Corporation (DFC) and the Multilateral Investment Guarantee Agency (MIGA), which provide technical assistance, financing, and insurance guarantees to reduce barriers to entry for companies seeking to invest in emerging markets. As a case in point: USG financing channeled via the DFC and MIGA increased by 2113%, from $103.7 Million in 2012 to $2.3 Billion in 2022, across the Indo-Pacific. In parallel, U.S. companies have turned to Indo-Pacific economies in higher-value add sectors such as technology which accounts for 24% of trade flows over the period. This evolution from aid provider to investment partner reflects the growing dynamism of Indo-Pacific economies, which have increasing potential to attract private sector capital at scale as more sustainable sources of revenue.

Private Philanthropies Expanded U.S. Support for Sustainable Development in the Indo-Pacific

Official development assistance (e.g., grants and loans with no- or low-interest rates) remains an important source of financing for Indo-Pacific economies to advance their development goals in critical sectors. The USG channeled $53.6 Billion in concessional financing to the Indo-Pacific via bilateral and multilateral channels. Complimenting these efforts, 20 U.S. private philanthropies mobilized $7 Billion in financing and programming to support Indo-Pacific economies—an uptick of 66 percent between 2012 and 2022. Taken together, private philanthropic flows and bilateral USG assistance helped Indo-Pacific communities further sustainable development outcomes in critical sectors such as health ($14.2 Billion), infrastructure ($8.4 Billion), education ($2.6 Billion), and environment and climate ($2.3 Billion).

Citation

Burgess, B., Mathew, D., Custer, S. & Custer, J. (2024). Securing Prosperity, Building Resilience: U.S. Economic Partnership in the Indo-Pacific. Williamsburg, VA: AidData at William & Mary. Retrieved from: www.aiddata.org/publications/securing-prosperity-building-resilience-us-economic-partnership-in-the-indo-pacific

Acknowledgements

The views expressed in this report are those of the authors and should not be attributed to AidData or funders of AidData's work. Funding for this report included a grant from the U.S. Department of State.

About AidData

AidData is a research lab at William & Mary’s Global Research Institute in Williamsburg, Virginia, USA. AidData helps governments and organizations make better-informed decisions on the reach, influence, and outcomes of overseas investments. We use rigorous methods, cutting-edge tools, and granular data to answer the question: who is doing what, where, for whom, and to what effect? This project triangulated multiple data sources to understand the value of the U.S. partnership with 46 Indo-Pacific economies across several channels: direct bilateral assistance from USG agencies, the nominal value of USG indirect contributions via multilaterals, private sector investment, and philanthropic flows over 11 years (from 2012 to 2022).